Sustainable Cities & Communities

Sustainable Cities & Communities

Rapid Own Source

Revenue Analysis

An evidence-based, quantitative decision-making tool for local finance practitioners seeking to optimize own-source revenues (OSRs) in subnational governments.

Start Analysis

What is the ROSRA?

ROSRA (Rapid Own Source Revenue Analysis) is a UN Habitat diagnostic tool that helps local governments see where their own source revenue (OSR) system stands today and how much room there is to improve under current legislation. ROSRA uses a quantitative approach: it estimates actual OSR gaps and shows how much revenue is being left untapped. In doing so, it helps local governments gauge the gravity of specific gaps and develop and prioritise practical reform options within the existing legal framework. By expressing OSR weaknesses in clear quantitative terms, ROSRA also helps mobilise political support for reforms and assess the potential return on investment from tackling specific shortcomings.

The ROSRA combines a high level view of the fiscal context with a more detailed look at individual revenue streams. The high level, "top down" analysis gives users a near immediate snapshot of their OSR performance relative to peers. For a more precise understanding of where revenue potential is foregone, users can then carry out the granular "bottom up" analysis, which decomposes administrative gaps stream by stream and links them to concrete solutions.

Strategic Decision Making

Facilitates informed decision-making through clear visualization of OSR gaps

Reform Prioritization

Helps prioritize interventions and allocate resources effectively

Enhanced Creditworthiness

Strengthens municipal finance foundations and improves access to resources

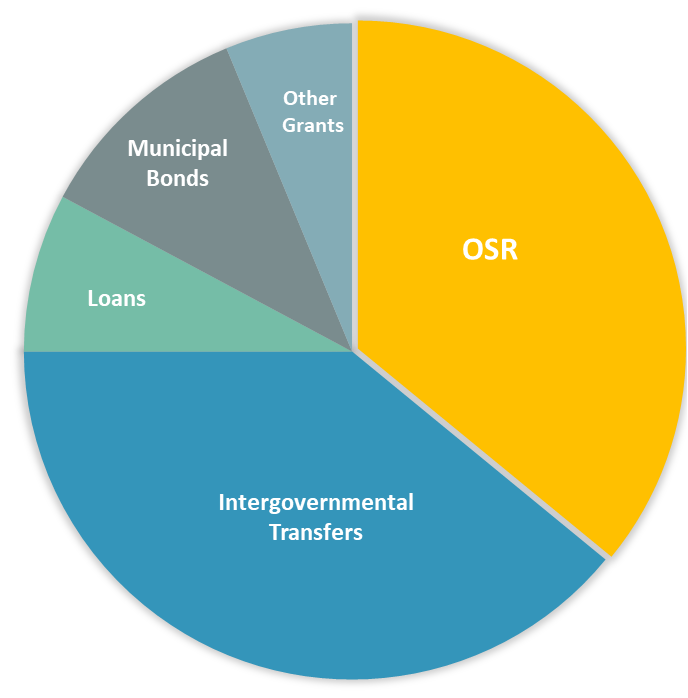

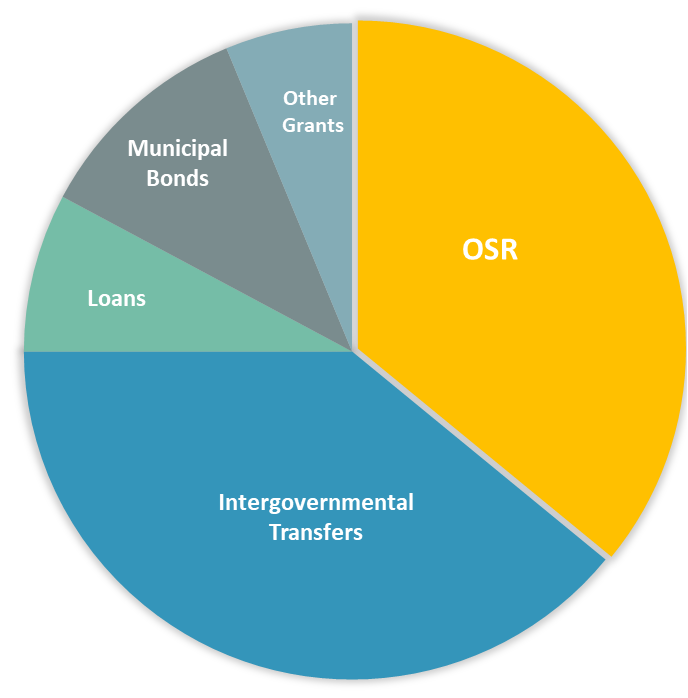

What is Own Source Revenue (OSR)?

OSR is one of several revenues of local governments

OSRs are taxes, fees, licenses, etc. which are directly controlled by local governments

Common OSR's

Why optimize OSR?

Increases Resources

It helps close unfunded mandates, maintain existing infrastructure and invest in development.

Increases Autonomy

When OSR is low, local governments are likely to be dependent on inter-governmental transfers (IGT) to cover the expenditure needs.

Strengthens Social Contract

When local governments collect taxes and fees, they become more accountable to their constituency.

Improves Institutional Capacity

Optimizing local revenue also often requires improvements in the space of accounting, expenditure, procurement, usage of technology and auditing practices.

Enables Leveraging

The local revenue system impacts economic growth, income distribution, and can be used to correct other market failures e.g. urban sprawl.

Increases Creditworthiness

Creditors assess the overall likelihood of debt repayment in part based on local revenue generation.

Who is the ROSRA for?

The ROSRA was designed primarily for government officials in local governments in low-income and fragile state contexts.

It can also be used by non-governmental partners as long as these have access to revenue related data of local governments.

Better suited for secondary cities rather than very large urban metropoles

Functions best when supported by senior management with technical staff input

Particularly helpful where land-based finance systems are present at the local level

How does the ROSRA work?

Analysis Process

The ROSRA analyses user data by comparing it with accepted benchmarks and the specific characteristics of well-functioning OSR systems observed in peer local governments.

Data Requirements

Required Input Data

Socio-economic data

GDP, population statistics

Budget data

Revenue and OSR data from past financial year

Management data

Overall OSR environment, management and administration details

Data Privacy

Only visible to the local government itself

UN-Habitat will only use the data after gaining explicit formal permission from the local government

The data input into the ROSRA is completely confidential

Selected Comments about the ROSRA

Why Choose UN-Habitat?

Data

We bring the best of global data paired with exemplary analysis to provide governments and partners with the most tailored and effective recommendations.

Experience & Expertise

We have global experience on municipal finance issues in many countries and contexts. Our network of experts bring extensive knowledge.

Funds Mobilization

When you are supported by a UN agency, it becomes easier to mobilize funding from other sources.

Political Weight

The UN name in partnership with your government will be sure to provide credibility and political stature to act on recommendations.

Ready to Optimize Your Revenue Systems?

Start analyzing your revenue gaps and unlock your municipality's financial potential.

Get Started Today

"The ROSRA shows us that we have essentially been doing everything wrong in regard to OSR"

Mr George Okong'o - County Executive Committee Member for Finance and Economic Planning

"This is the most accurate analysis of our OSR system that we have received until now and it is spot on"

Mr. Eric Orangi - Former Chief Officer Finance Kisumu County

"I am not aware that such a tool exists, and it is quite needed to support local governments in optimizing their OSR"

Professor Enid Slack - Professor, University of Toronto

"This tool adopts an interesting and promising methodology to support local governments in the critical area of OSR"

Professor William McCluskey - Professor, African Tax Institute